Form 1099-NEC Instructions & Tax Reporting Pointers

Beginning in 2020, the 1099-NEC started being used to report payments of $600 or more to service providers — typically work done by an independent contractor who is a sole proprietor or member of a partnership. Examples include graphic designers, Web developers, cleaning professionals, freelance writers, landscapers and other self-employed individuals. Basically, the 1099-NEC form is to independent contractors what the W-2 is to employees.

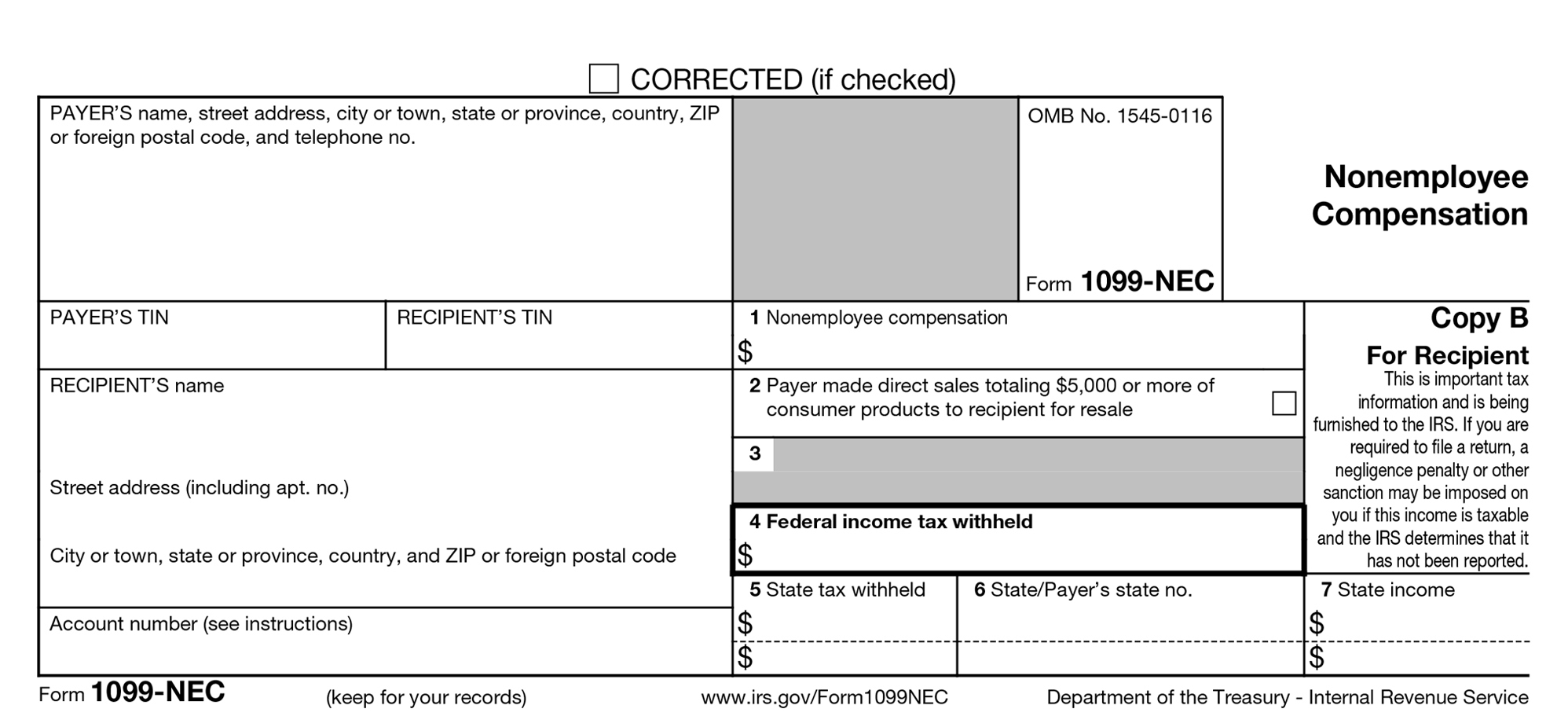

The 1099-NEC captures non-employee compensation, in addition to documenting that you didn’t deduct any federal, state or other taxes. Unlike employees with W-2s, independent contractors get their full pay without any automatic deductions. It’s up to them to keep track of their taxes and pay them directly to the government.

To complete a 1099-NEC, you'll need to supply the following data:

Business information – Your Federal Employer ID Number (EIN), your business name and your business address.

Recipient's ID Number – The recipient's Social Security number or Federal Employer ID Number (EIN).

Report Sales – Use Box 2 (or Box 7 on the 1099-MISC) to report sales of $5000 or more of consumer products for resale, on buy-sell, deposit-commission, or any other basis.

Payment Amounts – Enter nonemployee compensation amounts paid in Box 1.

Federal Income Tax Withheld – Enter any amounts of federal income tax withheld from payment in Box 4. (You'll use this if you’re sending a 1099-NEC to an individual who refused to provide a W-9 or TIN. In this case, the federal government may require you to withhold 24% of the money you paid and send it the IRS.)

There may be instances in which you need to provide both a 1099-MISC and 1099-NEC to the same individual, however that will depend on the business conducted with them in that year. If you are unsure it's always best to consult a tax attorney in order to remain compliant.

Get more tips on how to determine who gets a 1099-NEC form here.

Our free e-guide includes everything you need to know to legally and effectively work with independent contractors.

Get additional information on completing a 1099-NEC form here.

The 1099-NEC is a multi-part form that is handled as follows:

Copy A — File with IRS by the paper or electronic-filing deadline.

Copy 1/State Copy — File with the appropriate state taxing authority, if applicable.

Copy B — Distribute this copy to individuals, who then file it with their federal income tax return. It must be delivered by January 31. You will meet the IRS’ distribution requirement if the form is properly addressed and mailed on or before this due date.

Copy 2 — Distribute this copy to individuals. If applicable, individuals will then file this copy with their state taxing authority. Again, it generally must be delivered by January 31.

NOTE: When the due date falls on a weekend or legal holiday, the form due date is moved to the next business day.

How do you file your information returns? If you’re using paper forms or software, you’re spending way more time and effort than needed.

Whether you’re filing one form or a hundred, doing it online is a much more efficient, streamlined process. Say goodbye to the time-consuming task of filling out paper forms manually or downloading and navigating software. With cloud-based e-filing, you just enter or upload your data and the e-file provider processes, prints, mails and files for you. You’ll enjoy secure and accurate 1099 filings, as well as greater flexibility and convenience. Everything is at your fingertips and easily accessible — anytime, anywhere.

Free to try.

You only pay when you're ready to file.